The Backbone of Automation – Why 5kW Servo Motors Matter

India’s manufacturing sector is undergoing a seismic shift. Factories are no longer just about manpower and machinery; they’re about precision, efficiency, and adaptability. At the heart of this transformation lies the humble yet mighty servo motor—specifically, the 5kW servo motor. This workhorse of automation is driving everything from CNC machines to robotic arms, but its price tag remains a hot topic for engineers, procurement managers, and business owners alike. Let’s unpack what makes this motor indispensable—and what factors dictate its cost in the Indian market.

.webp)

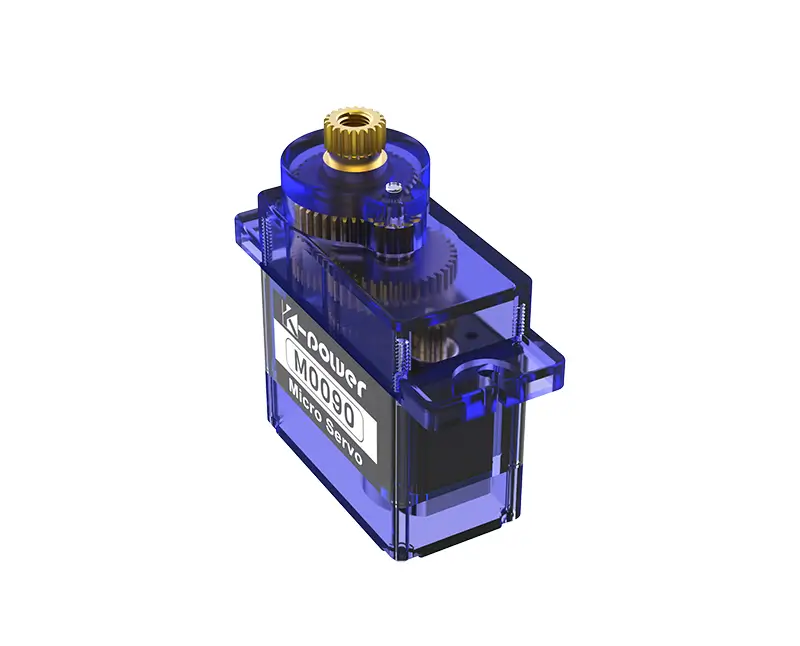

The 5kW Sweet Spot: Balancing Power and Practicality

A 5kW servo motor strikes a unique balance. It’s powerful enough to handle mid-to-heavy industrial loads—think packaging lines, textile machinery, or automotive assembly systems—without the energy drain of higher-capacity models. In a country like India, where industries juggle cost constraints and performance demands, this motor has become a go-to solution. But what exactly are you paying for?

Precision Engineering: Servo motors thrive on accuracy. Unlike standard motors, they use feedback systems (encoders) to adjust speed, torque, and position in real time. A 5kW motor with a high-resolution encoder can cost 15–20% more than a basic model, but the ROI in reduced waste and downtime is undeniable. Brand Equity: Japanese and German brands like Yaskawa, Mitsubishi, and Siemens dominate the premium segment, with prices ranging from ₹1.2 lakh to ₹2.5 lakh. Indian and Chinese alternatives (e.g., Allen Bradley, Delta) offer budget-friendly options (₹70,000–₹1.5 lakh) but may compromise on longevity in high-stress environments. Integrated vs. Standalone Systems: Some motors come with built-in drives or controllers, simplifying installation. These “all-in-one” units command a premium but save on auxiliary costs.

The Hidden Forces Shaping Prices

Beyond specs, macroeconomic and logistical factors play a massive role:

Import Dependency: Over 60% of India’s servo motors are imported. Fluctuating forex rates, shipping delays, and customs duties (18–28%) can inflate prices overnight. The recent chip shortage further strained supply chains, pushing lead times from weeks to months. Local Manufacturing Push: The Make in India initiative is slowly changing the game. Companies like Bharat Bijlee and CG Power are rolling out indigenous 5kW models priced 10–15% lower than imports. However, adoption is hampered by perceptions of inferior quality. Energy Efficiency Standards: IS 12615:2018 mandates minimum efficiency levels for motors. Compliance adds R&D and production costs, but motors meeting these standards qualify for subsidies, indirectly lowering buyer expenses.

Case Study: A Textile Giant’s Dilemma

Consider a Surat-based textile manufacturer upgrading its looms. The choice between a ₹95,000 Chinese motor and a ₹1.8 lakh Japanese model isn’t just about upfront cost. The cheaper motor might save ₹85,000 initially but could lead to frequent breakdowns, costing ₹2 lakh/year in repairs and lost output. The pricier option, with a 5-year warranty, offers predictable performance. This calculus is why many mid-sized Indian firms are leaning toward mid-tier brands like Delta or Teco, which blend affordability with reliability.

Navigating the Market – Trends, Prices, and Smart Buying Tips

The Price Spectrum: What to Expect in 2024

As of Q2 2024, 5kW servo motor prices in India vary wildly:

Budget Tier (₹70,000–₹1.1 lakh): Chinese imports and nascent Indian brands. Suitable for light-duty applications but may lack durability. Mid-Tier (₹1.1 lakh–₹1.8 lakh): Taiwanese and Indian-assembled motors with imported components. Balances cost and performance for most SMEs. Premium Tier (₹1.8 lakh–₹3 lakh+): Global brands with advanced features like IoT connectivity or ultra-high torque. Ideal for heavy industries like automotive or aerospace.

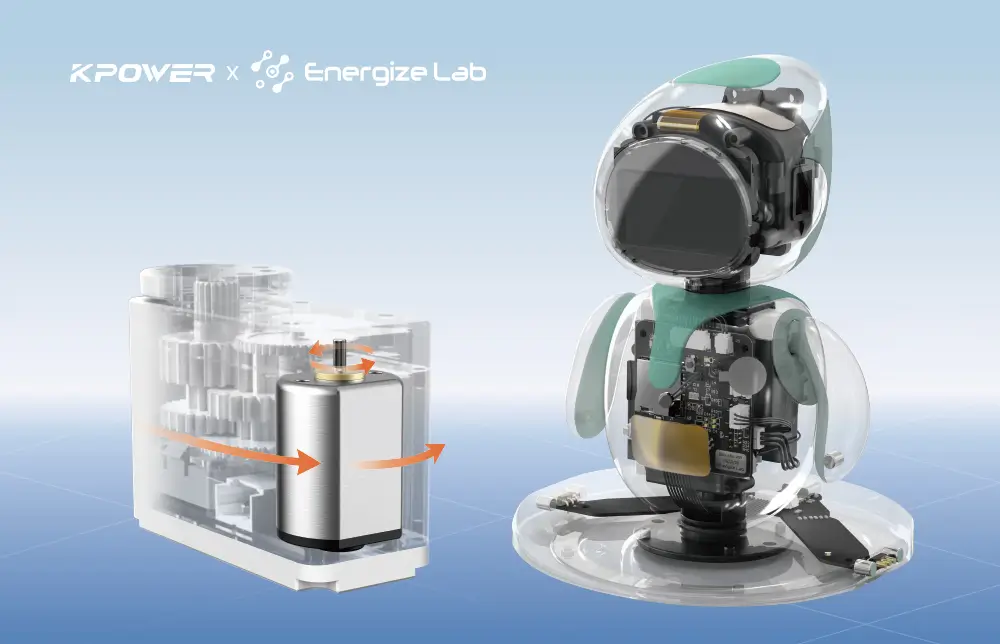

Emerging Trends Disrupting the Market

Localization 2.0: Companies like Siemens are setting up assembly units in India to cut costs. A “Made in India” Siemens Simotics S-1FK2 motor now costs 12% less than its German counterpart. Rise of Refurbished Motors: With sustainability in focus, certified refurbished motors (30–40% cheaper) are gaining traction in sectors like plastics and food processing. Smart Motors: Motors with embedded sensors for predictive maintenance are entering the market. While 20–25% pricier, they reduce unplanned downtime by up to 50%.

How to Buy Wisely: A Checklist for Buyers

Total Cost of Ownership (TCO): Factor in energy consumption, maintenance, and lifespan. A ₹1.2 lakh motor with a 10-year life beats a ₹80,000 motor needing replacement every 3 years. Supplier Credentials: Opt for distributors with in-house technical support. A Mumbai-based automation firm recently saved ₹4 lakh/year by choosing a vendor offering free troubleshooting. Future-Proofing: Ensure compatibility with Industry 4.0 upgrades. Motors supporting MODBUS or EtherCAT protocols might cost extra today but prevent obsolescence tomorrow.

The Road Ahead

India’s servo motor market is projected to grow at 8.5% CAGR, driven by automotive and electronics sectors. As local production scales up, prices will stabilize, but quality disparities will persist. For now, savvy buyers must weigh short-term savings against long-term gains—because in the race toward automation, the right motor isn’t just a purchase; it’s a strategic investment.

.webp)