Understanding HS Codes and Their Importance in Global Trade

In the fast-paced world of international trade, HS codes act as the universal language that bridges borders. Standing for Harmonized System codes, these six to ten-digit numbers are the backbone of customs declarations, tariff calculations, and trade statistics. For businesses dealing with specialized equipment like servo motors, mastering HS codes isn’t just a bureaucratic formality—it’s a strategic necessity.

.webp)

What Are HS Codes?

Developed by the World Customs Organization (WCO), HS codes categorize over 5,000 product groups to standardize global trade. The first six digits are universal across 200+ countries, while additional digits (up to 10) allow nations to specify subcategories. Misclassifying goods can lead to delayed shipments, fines, or even legal disputes, making accuracy critical.

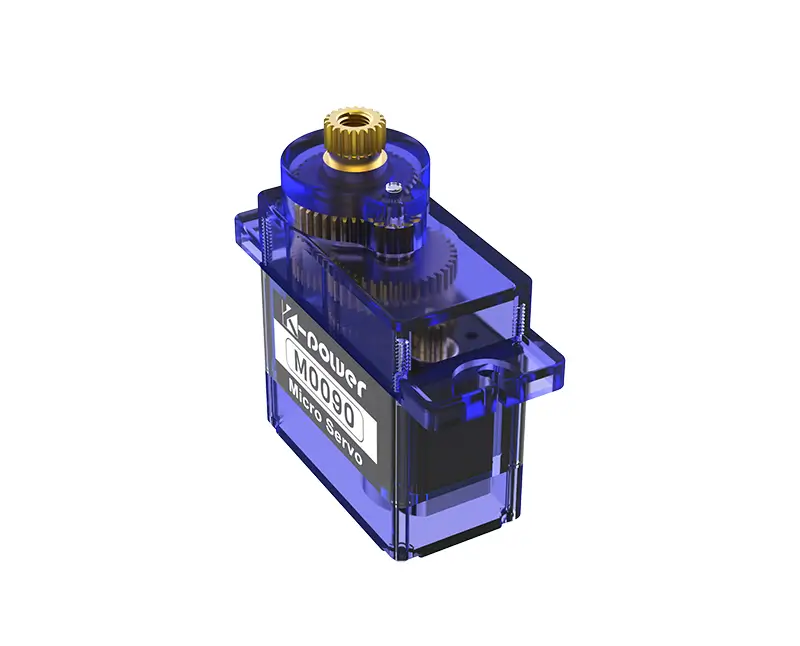

Why Servo Motors Demand Precision in Classification

Servo motors are the unsung heroes of automation, robotics, and precision manufacturing. Unlike standard motors, they incorporate feedback systems for exact control of position, speed, and torque. This complexity means they don’t fit neatly into generic "electric motor" categories. Misclassification could result in overpaying tariffs or facing regulatory scrutiny.

Decoding the HS Code for Servo Motors

The primary HS code for servo motors typically falls under 8501, which covers electric motors and generators. However, the exact classification depends on technical specifications:

8501.10: Motors of an output ≤ 37.5 W (used in small devices like drones). 8501.20: AC motors (common in industrial automation). 8501.30: DC motors (favored for robotics and electric vehicles). 8501.40: Universal motors (rare for servo applications).

Countries may add extra digits. For example, the U.S. uses 8501.20.4000 for AC servo motors under the Harmonized Tariff Schedule (HTS).

Common Pitfalls in Servo Motor Classification

Ignoring Feedback Mechanisms: Servo motors include encoders or resolvers for closed-loop control. Classifying them as basic motors (e.g., under 8501.10) risks underpayment. Overlooking Power Ratings: A 50W servo motor might fall under 8501.10, while a 100W motor shifts to 8501.20. Mixing Motor Types: Brushless vs. brushed DC servo motors can trigger different duty rates.

A European importer once faced a 12% tariff hike after misdeclaring a 500W AC servo motor under 8501.10 instead of 8501.20, leading to a six-figure penalty.

The Role of HS Codes in Tariff Optimization

Correct classification isn’t just about compliance—it’s a financial lever. For instance, the U.S. imposes a 2.5% duty on 8501.20.4000 (AC servo motors) but 4% on 8501.30.6000 (DC servo motors). Savvy traders use Free Trade Agreements (FTAs) to reduce costs. A U.S.-Mexico-Canada Agreement (USMCA) beneficiary importing a servo motor from Canada could slash duties to 0%.

Navigating Customs Challenges for Servo Motors: A Step-by-Step Guide

Classifying servo motors under HS codes requires technical and regulatory expertise. Here’s how to streamline the process and avoid costly errors.

Step 1: Gather Detailed Product Specifications

Start with:

Power Output: Measured in watts (W) or horsepower (HP). Current Type: AC, DC, or universal. Voltage Rating: 12V, 24V, 48V, etc. Feedback System: Encoder type (optical, magnetic) or resolver. Application: Industrial, automotive, medical, etc.

A 100W brushless DC motor with an encoder for robotic arms will have a different code than a 30W AC motor for HVAC systems.

Step 2: Consult Customs Databases and Rulings

Leverage official resources:

WCO Trade Tools: The WCO’s online database offers cross-references. Customs Binding Rulings: Countries like the U.S. (CBP) and EU members issue legally binding classifications upon request. HS Code Finders: Tools from logistics providers like DHL or FedEx provide preliminary guidance.

Step 3: Collaborate with Experts

Customs brokers and trade attorneys add value by:

Interpreting ambiguous product descriptions. Identifying regional variations (e.g., China’s 13-digit HS codes). Advising on tariff engineering—modifying designs to qualify for lower-duty codes.

Regional Variations: A Double-Edged Sword

While the first six HS digits are global, countries add nuances:

United States: HTSUS codes include 10 digits. Servo motors for aerospace might qualify for duty-free treatment under HTS 9808.00.30. European Union: The Combined Nomenclature (CN) adds two digits. Servo motors integrated with controllers may fall under 8537.10. China: Customs may require factory inspection reports to verify motor specifications.

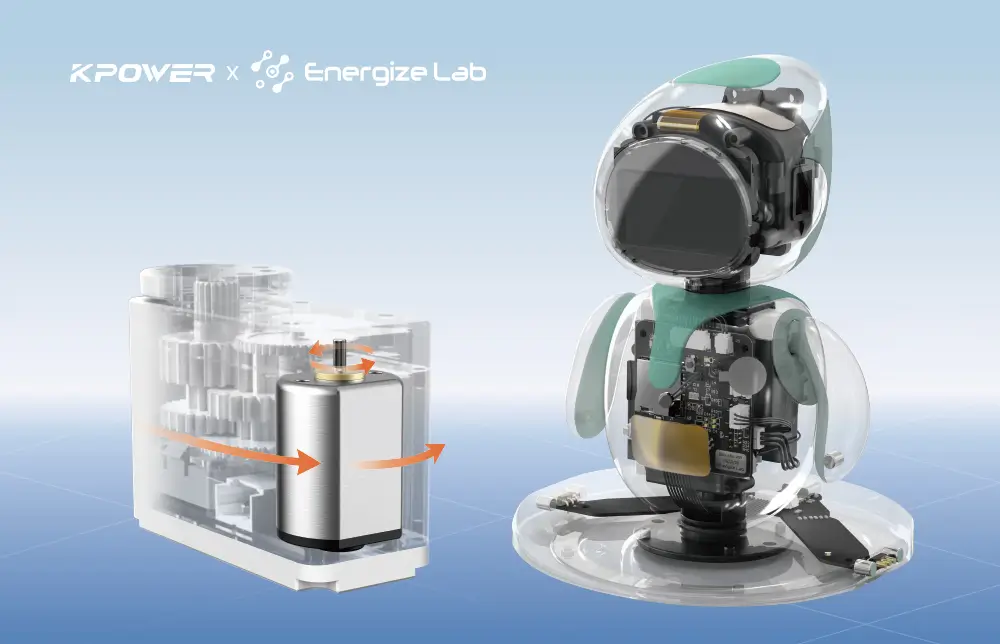

The Impact of Evolving Technology

As servo motors integrate IoT and AI capabilities, classification becomes trickier. A "smart" servo motor with embedded sensors could straddle multiple codes:

8501: For the motor itself. 8543.70: For sensors and IoT modules. 8517.62: If it includes wireless communication.

Customs authorities are increasingly scrutinizing multifunctional devices, so transparent documentation is vital.

Case Study: Avoiding Costly Delays in Automotive Trade

A German automaker importing Japanese servo motors for assembly lines faced a customs hold in Brazil. The issue? The HS code 8501.20.90 (AC motors > 750W) lacked documentation proving the motors weren’t subject to anti-dumping duties. By pre-submitting test reports and invoices, the company resolved the delay within 72 hours.

Best Practices for HS Code Compliance

Audit Regularly: Review classifications annually or after product redesigns. Train Teams: Ensure procurement and logistics staff understand technical specs. Use Automation: AI-powered classification software like Descartes or SAP GTS reduces human error. Maintain Records: Keep datasheets, rulings, and correspondence for audits.

The Future of HS Codes and Servo Motors

The 2027 HS code revision is expected to address green technologies, potentially creating subcategories for energy-efficient servo motors. Traders advocating for clearer guidelines can participate in WCO public consultations.

Conclusion: Mastering HS Codes as a Competitive Edge

In global trade, precision is profit. Correctly classifying servo motors under HS codes ensures compliance, minimizes duties, and accelerates cross-border movement. By combining technical knowledge with strategic planning, businesses can turn regulatory complexity into a competitive advantage—one optimized shipment at a time.

.webp)