The Backbone of Automation: Servo Motors and Their Global Footprint

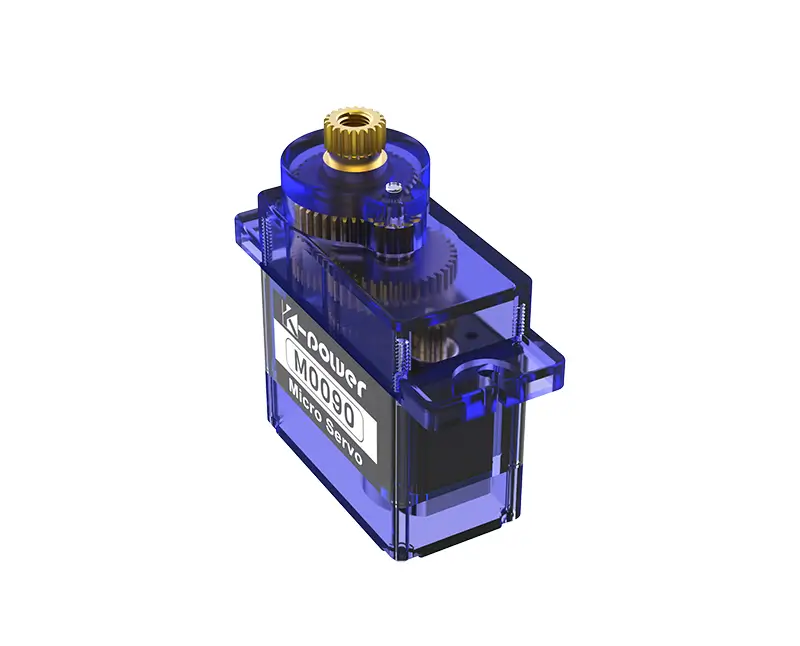

In an era where automation drives industries from manufacturing to healthcare, servo motors have emerged as unsung heroes. These precision devices, capable of delivering exact control over speed, torque, and position, are integral to robotics, CNC machinery, and even aerospace systems. But as businesses expand globally, a critical question arises: How do you classify servo motors for international trade? The answer lies in understanding HSN codes.

.webp)

What Are HSN Codes?

The Harmonized System of Nomenclature (HSN) is a globally standardized six-digit code system used to classify traded products. Developed by the World Customs Organization (WCO), it simplifies cross-border taxation, tariffs, and regulatory compliance. Over 200 countries adopt this system, with many adding extra digits for domestic specificity. For instance, India uses eight-digit HSN codes under GST, while the U.S. employs a 10-digit Harmonized Tariff Schedule (HTS).

Decoding the HSN for Servo Motors

Servo motors fall under HSN Code 8501, which covers "electric motors and generators." However, their precise classification depends on technical specifications:

8501.10: Motors ≤ 37.5 watts (used in small appliances). 8501.20: DC motors. 8501.30: AC motors (single-phase). 8501.40: AC motors (multi-phase, ≤ 750 watts). 8501.80: Other motors (including specialized servo motors).

In India, servo motors often use 8501.80.10, attracting 18% GST. Misclassification here—such as lumping servo motors under generic codes—can trigger audits or penalties.

Why Accurate HSN Classification Matters

Tariff Determination: Correct codes ensure proper duty calculations. For example, a servo motor classified under 8501.80 instead of 8501.40 might face higher tariffs. Regulatory Compliance: Authorities mandate HSN codes on invoices and shipping documents. Errors delay customs clearance. Market Access: Some countries restrict imports of certain motor types. Precise coding avoids legal hurdles.

A 2022 study by the Global Trade Research Initiative found that 30% of customs disputes stem from incorrect HSN codes, costing businesses millions annually.

#

Navigating Challenges in Servo Motor HSN Code Classification

While HSN codes provide a structured framework, classifying servo motors isn’t always straightforward. Factors like evolving technology, hybrid functionalities, and regional variations complicate compliance. Let’s explore these challenges and strategies to overcome them.

Common Pitfalls in Servo Motor Classification

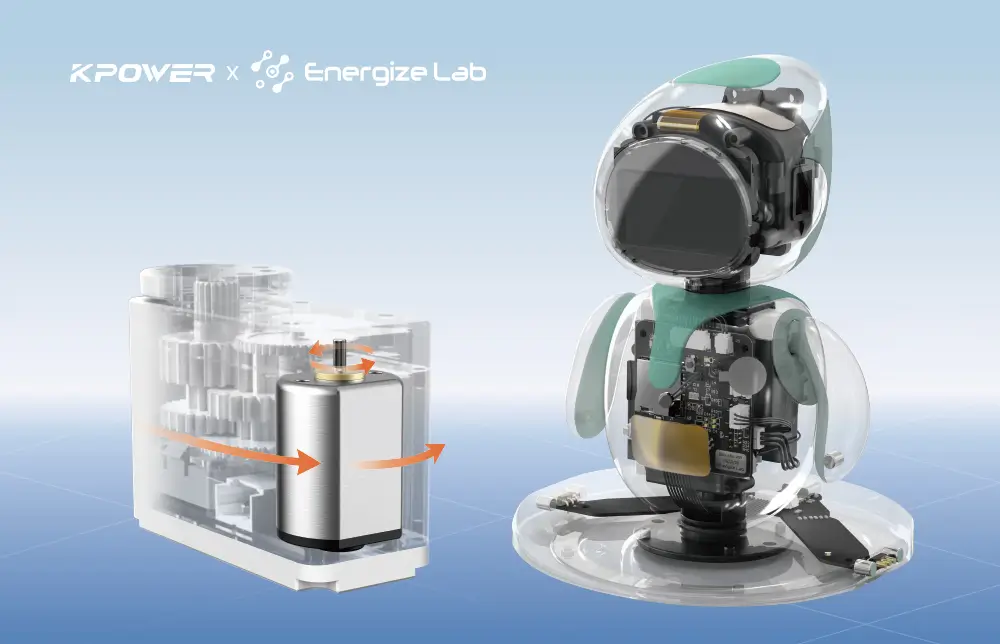

Overlooking Technical Specifications: Servo motors often integrate with drives, encoders, or controllers. For example, a "servo system" combining a motor and drive might fall under 8537 (control panels) instead of 8501. Misclassifying such integrated systems risks penalties.

Misinterpreting Power Ratings: A servo motor’s wattage determines its HSN subcategory. A motor rated at 800W (just above the 750W threshold for 8501.40) could mistakenly be classified under a lower-duty code, leading to underpaid taxes.

Regional Variations: While HSN codes are harmonized, countries add extensions for local regulations. For instance:

The EU uses 8501.80.90 for servo motors exceeding 750W. The U.S. HTS code 8501.31.0040 specifies AC servo motors with positional feedback. Failing to recognize these nuances can disrupt supply chains.

Case Study: A Costly Misclassification

In 2021, a German robotics firm imported servo motors into India under HSN 8501.40 (AC motors ≤750W). However, the motors were designed for industrial robots, with built-in encoders and 1kW power. Indian customs reclassified them under 8501.80.10, slapping a 25% duty (vs. 18% GST) and a $120,000 penalty. The error? Ignoring wattage and auxiliary components.

Best Practices for Accurate HSN Code Assignment

Collaborate with Technical Teams: Engineers can clarify motor specs (e.g., power, voltage, integrated features). A 2023 McKinsey report found that cross-departmental collaboration reduces classification errors by 40%.

Leverage Customs Rulings: Many countries offer binding tariff rulings. For example, U.S. Customs’ “CROSS” database provides precedents. A ruling for a 2kW servo motor with IoT connectivity (classified under 8501.80 in 2022) can guide similar cases.

Use AI-Powered Tools: Platforms like Descartes CustomsInfo and SAP Global Trade Services automate code lookup using machine learning. These tools cross-reference product descriptions, technical sheets, and regional databases to suggest codes with 95% accuracy.

Audit Regularly: Conduct internal audits to ensure codes align with updated product designs or regulatory changes. For instance, India’s 2023 GST amendment reclassified some servo-driven medical devices under 9018 (medical instruments), impacting motor suppliers.

The Future of HSN Codes and Smart Servo Motors

As Industry 4.0 reshapes automation, servo motors are becoming smarter. IoT-enabled motors with self-diagnostic features blur the lines between electromechanical devices (HSN 8501) and data-driven equipment (HS 8471 or 8543). Regulatory bodies are racing to adapt:

The WCO’s 2024 draft proposes a new subcategory (8501.80.20) for motors with embedded sensors. The EU’s “Digital HSN” initiative aims to link codes to real-time product data via blockchain.

Conclusion: Mastering HSN Codes for Competitive Advantage

In global trade, HSN codes are more than bureaucratic red tape—they’re strategic tools. Accurate classification of servo motors ensures faster customs clearance, optimized tariffs, and compliance with sanctions or sustainability mandates (e.g., motors meeting EU’s Ecodesign standards). By investing in training, technology, and partnerships, businesses can turn HSN compliance into a competitive edge, unlocking seamless access to the $1.5 trillion industrial automation market.

Final Note: Always consult a certified customs broker or trade attorney for jurisdiction-specific advice. The dynamic nature of HSN codes demands vigilance, but the rewards—risk mitigation and market agility—are well worth the effort.

.webp)