Understanding HSN Codes and Their Role in Servo Motor Classification

In the fast-paced world of industrial automation and robotics, servo motors have emerged as indispensable components, powering everything from CNC machines to advanced medical equipment. However, for businesses in India, navigating the regulatory landscape—specifically the Harmonized System of Nomenclature (HSN) codes—can feel like deciphering a complex puzzle. This guide demystifies the HSN code system for servo motors, ensuring your business stays compliant, efficient, and ahead of the curve.

.webp)

What Are HSN Codes and Why Do They Matter?

The HSN code system, adopted by over 200 countries, is a standardized method to classify traded goods. India introduced this system under the Goods and Services Tax (GST) regime in 2017 to streamline taxation and reduce discrepancies. Each product, including servo motors, is assigned a unique 6-digit code, extended to 8 digits in India for finer categorization.

For businesses, accurate HSN coding is non-negotiable. It determines GST rates, ensures smooth interstate trade, and avoids legal penalties. Misclassification can lead to audits, fines, or shipment delays—risks no company can afford.

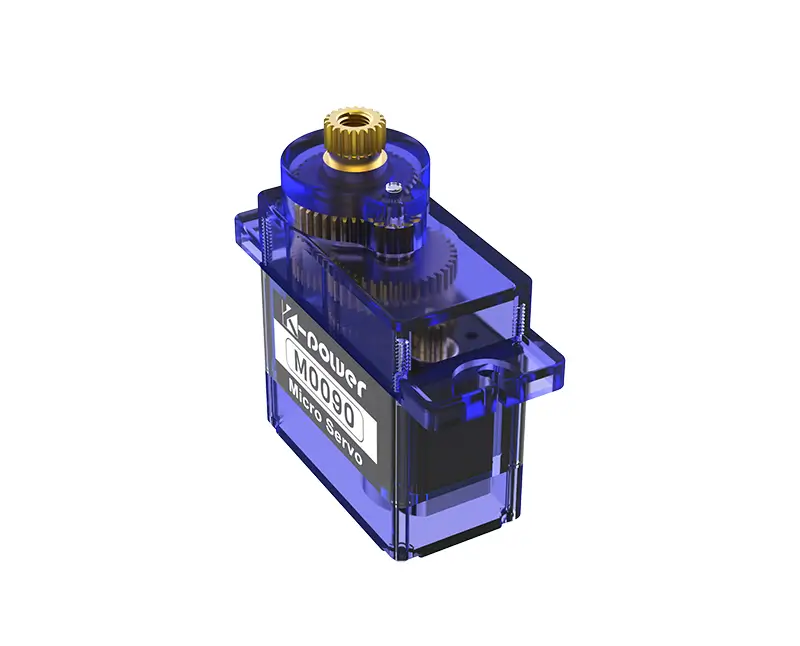

Decoding the HSN Code for Servo Motors

Servo motors fall under Chapter 85 of the HSN system: Electrical Machinery and Equipment. Here’s a breakdown of their classification:

8501: Electric motors (excluding generating sets). 8501 10: Motors of an output ≤ 37.5 watts. 8501 20: Universal AC/DC motors. 8501 30: Other DC motors. 8501 40: Other AC motors. 8501 51 to 8501 53: Multi-phase AC motors with specific power ranges.

In India, servo motors typically fall under 8501 50 or 8501 80, depending on their design and application. For example:

8501 50 90: AC servo motors (output > 750W). 8501 80 00: DC servo motors.

Why Accurate Classification Is Critical

GST Compliance: Servo motors attract a standard GST rate of 18%. Incorrect codes can lead to underpayment or overpayment of taxes. Export-Import Efficiency: Customs authorities rely on HSN codes to clear shipments. Errors cause delays and additional costs. Input Tax Credit (ITC): Proper classification ensures seamless ITC claims, improving cash flow. Industry-Specific Requirements: Servo motors used in renewable energy or defense may qualify for exemptions—only possible with precise coding.

Real-World Applications: Where Servo Motors Shine

Understanding HSN codes becomes even more critical when considering the diverse applications of servo motors:

Manufacturing: CNC machines, conveyor systems. Healthcare: MRI machines, surgical robots. Automotive: Assembly line automation. Aerospace: Precision control systems.

Each sector may have unique compliance requirements, making accurate HSN coding a strategic advantage.

Common Pitfalls to Avoid

Assuming One-Size-Fits-All: Servo motors vary by power, phase, and application. A universal motor’s code (8501 20) won’t fit a specialized AC servo. Overlooking Updates: HSN codes evolve. For instance, recent amendments added clarity to renewable energy equipment. Mixing with Stepper Motors: Though similar, stepper motors (8501 10) have distinct codes. Misclassification here is common.

By partnering with tax consultants or using GST portal tools, businesses can mitigate these risks.

Navigating Compliance and Maximizing Efficiency with HSN Codes

Step-by-Step Guide to Identifying Your Servo Motor’s HSN Code

Analyze Motor Specifications: Note the power output (watts), current type (AC/DC), and phase (single/multi). Consult the HSN Manual: Cross-reference Chapter 85 subheadings. Leverage Technology: Use GST portal’s “Search HSN” feature or AI-driven tax software. Seek Expert Validation: Customs brokers or CA firms can confirm your choice.

Case Study: A Costly Misclassification

A Pune-based robotics startup once classified its high-torque AC servo motors under 8501 30 (DC motors) to avoid higher taxes. During a GST audit, the error was flagged, resulting in a ₹12 lakh penalty and suspended ITC claims for two quarters. This underscores the importance of precision.

Industry Trends Shaping HSN Code Practices

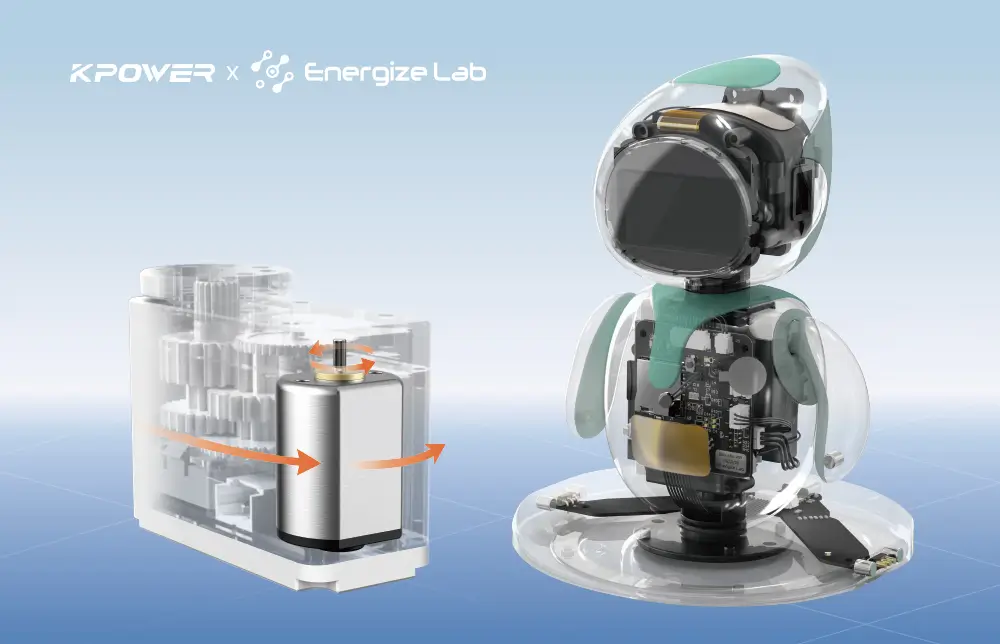

Smart Manufacturing: Industry 4.0 demands servo motors with IoT capabilities. These may fall under hybrid codes (e.g., 8501 50 90 + 8517 62 for embedded sensors). Sustainability Initiatives: Motors used in solar panel tracking systems could qualify for GST concessions under 8501 80 00 if certified as “green technology.” Customization: Bespoke servo motors for defense projects require codes aligned with the Ministry of Defence’s procurement guidelines.

Future-Proofing Your Business

Regular Training: Update your finance and logistics teams on HSN revisions. Digital Tools: Invest in ERP systems with built-in HSN databases. Collaborate with Peers: Industry forums often share coding best practices.

Conclusion: Turn Compliance into a Competitive Edge

Mastering HSN codes for servo motors isn’t just about avoiding penalties—it’s about unlocking efficiency. Accurate classification accelerates supply chains, optimizes tax outflows, and builds credibility with partners. As India’s manufacturing sector grows, businesses that prioritize compliance will lead the automation revolution.

Stay informed, stay compliant, and let your servo motors drive not just machines, but your success story.

.webp)