The Role of HSN Codes in Servo Motor Trade and Taxation

Introduction to HSN Codes: Simplifying Global Trade

The Harmonized System of Nomenclature (HSN) is a globally recognized coding system developed by the World Customs Organization (WCO) to classify traded products. With over 200 countries adopting this six-digit code structure, HSN ensures uniformity in customs procedures, tariffs, and taxation. For businesses dealing with servo motors—a critical component in automation and robotics—understanding the correct HSN code is essential for compliance, cost optimization, and seamless cross-border transactions.

.webp)

Why HSN Codes Matter for Servo Motors

Servo motors are precision devices used in industries like manufacturing, aerospace, and automotive for accurate motion control. Misclassifying these motors under the wrong HSN code can lead to:

Incorrect GST or VAT calculations Customs delays or penalties Lost tax credits Legal disputes

For instance, in India, the Goods and Services Tax (GST) Council mandates HSN codes for goods valued above ₹5 crore annually. Even smaller businesses must use a four-digit HSN code. Servo motors fall under a specific HSN category, and misclassification could result in overpaying taxes or non-compliance fines.

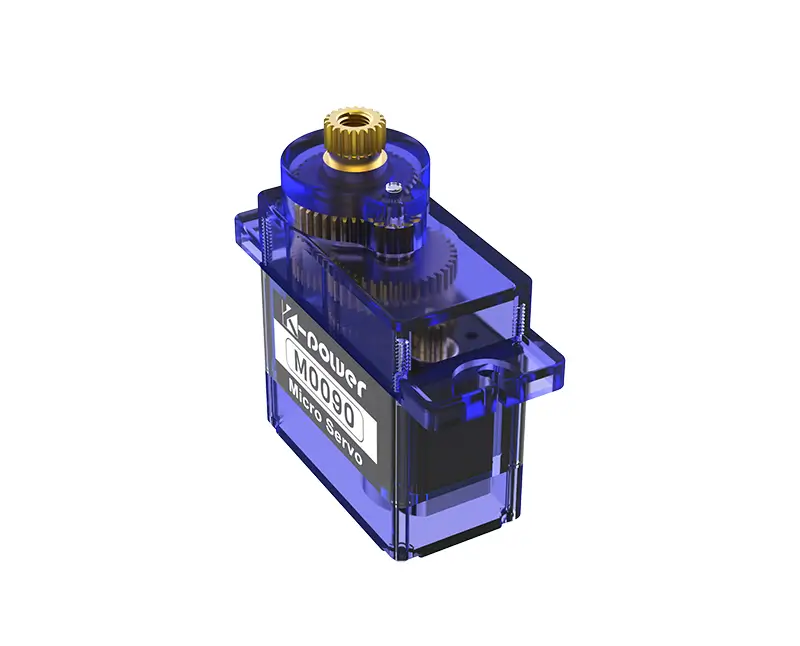

Decoding the HSN Code for Servo Motors

The HSN code for servo motors is 8501. Let’s break this down:

85: Electrical machinery and equipment (Chapter 85) 8501: Electric motors and generators (excluding generating sets)

However, servo motors often require further sub-classification based on:

Power Rating: Motors below 37.5W (8501.10) vs. those above (8501.20). AC/DC Type: AC motors (8501.30) and DC motors (8501.40). Special Features: Servo motors with encoders or feedback systems may fall under 8501.51 or 8501.59.

For example, a brushless DC servo motor with a power output of 100W would be classified under 8501.40.90 (DC motors > 37.5W).

GST Implications for Servo Motors in India

In India, servo motors under HSN 8501 attract a standard GST rate of 18%. This includes:

CGST: 9% SGST: 9%

However, exemptions or reduced rates may apply for:

Export-oriented units (EOUs) Special Economic Zones (SEZs) Projects under government schemes

Businesses must ensure accurate invoicing with the correct HSN code to claim Input Tax Credit (ITC). A mismatch between the supplier’s and buyer’s HSN codes can trigger audits or ITC denials.

Common Challenges in Servo Motor Classification

Differentiating Servo Motors from Stepper Motors: While both are used for precision control, stepper motors (HSN 8501.10) operate differently and may fall under a separate subheading. Integrated Systems: Servo motors bundled with drives or controllers may require a combined classification or separate codes. Global Variations: Countries like the U.S. (using HTS codes) or the EU (using CN codes) have slight deviations in subcategories.

Best Practices for Compliance

Consult Technical Specifications: Review motor nameplates for power, voltage, and type. Leverage Customs Rulings: Refer to past rulings or seek advance classification from authorities. Use Automation Tools: GST software with HSN databases can reduce manual errors.

Navigating International Trade and Future Trends in Servo Motor HSN Codes

Servo Motors in Global Supply Chains: Tariffs and Documentation

Classifying servo motors correctly under HSN 8501 is critical for calculating import/export duties. For example:

U.S. Importers: The HTS code 8501.20.0040 applies to AC servo motors, attracting a 2.5% duty. EU Importers: Under CN code 8501.10.00, motors below 37.5W face 0% duty, while others may incur 4.5%.

Key documents must align with the HSN code:

Commercial Invoice Packing List Bill of Lading Certificate of Origin

Discrepancies can lead to customs holds. For instance, a German buyer rejecting a shipment due to an incorrect HSN code could result in costly re-exportation.

Case Study: How a Robotics Startup Avoided Penalties

A Bengaluru-based automation startup exporting servo motors to South Korea initially classified their products under HSN 8501.59 (other AC motors). However, Korean customs flagged the shipment, arguing the motors fell under 8501.51 (servo motors with feedback systems). By providing technical manuals and test reports, the startup proved compliance with 8501.51, avoiding a 15% penalty. This highlights the importance of granular classification.

Future Trends Impacting HSN Codes for Servo Motors

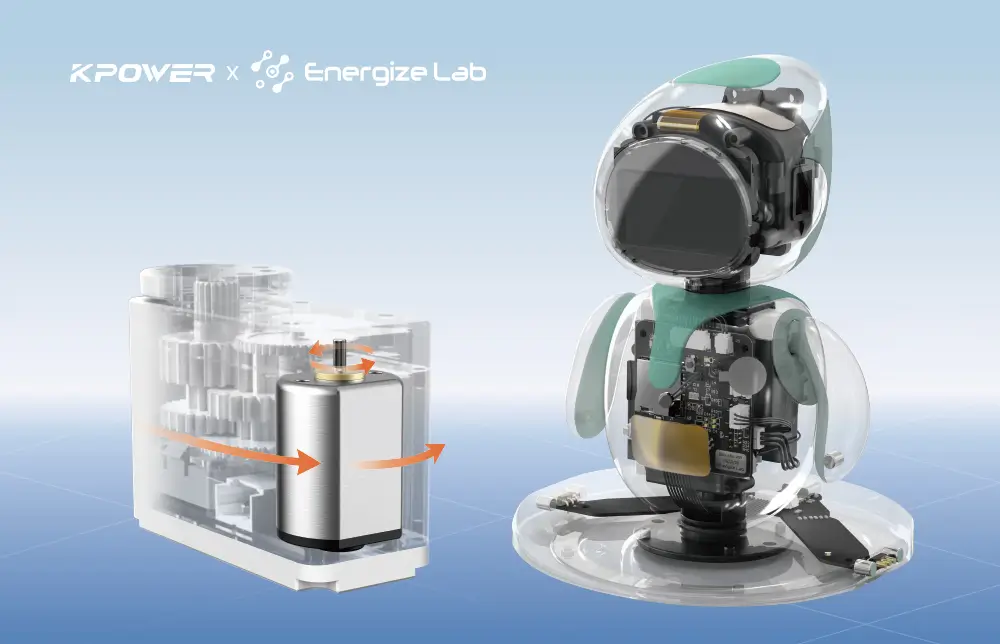

Smart Manufacturing: IoT-enabled servo motors with embedded sensors may require new subcategories under HSN 8501. Sustainability Initiatives: Motors designed for energy efficiency (e.g., IE4 standards) could qualify for tax rebates under green HSN codes. Customs Digitization: Blockchain-based systems may automate HSN validation, reducing classification errors.

How to Stay Updated on HSN Changes

Subscribe to Customs Alerts: Platforms like ICEGate (India) or Customs Trade Portal (U.S.) provide updates. Join Industry Associations: Organizations like the Robotics Industries Association (RIA) offer classification guides. Attend Trade Webinars: Experts often discuss HSN revisions and case studies.

Conclusion: Mastering HSN Codes for Competitive Advantage

Accurate HSN classification for servo motors isn’t just about compliance—it’s a strategic tool for cost savings and market expansion. By investing in training, technology, and expert consultations, businesses can turn regulatory complexity into a competitive edge. As global trade evolves, staying ahead of HSN trends will ensure smoother operations and stronger profitability in the automation era.

This structured guide equips businesses with actionable insights to navigate HSN codes for servo motors confidently. Whether you’re an importer, exporter, or manufacturer, precision in classification paves the way for growth in the dynamic world of industrial automation.

.webp)