Understanding HSN Codes and Their Importance for Servo Motor Power Cables

In the fast-paced world of industrial automation, servo motors are the unsung heroes driving precision and efficiency. But behind every high-performance servo motor lies a critical component: the power cable. While engineers focus on torque and feedback systems, businesses must navigate a less glamorous yet equally vital aspect—tax compliance. This is where Harmonized System Nomenclature (HSN) codes come into play.

.webp)

What Are HSN Codes?

HSN codes are a globally standardized system for classifying traded products. Introduced by the World Customs Organization (WCO), these six-digit codes simplify international trade by ensuring uniformity in customs documentation. Countries like India extend this to eight digits for granular tax categorization under GST. For businesses dealing with servo motor power cables, selecting the correct HSN code isn’t just bureaucratic red tape—it’s a strategic necessity.

Why HSN Codes Matter for Servo Motor Power Cables

Tax Compliance: Misclassification can lead to underpayment or overpayment of GST, inviting penalties. Supply Chain Efficiency: Accurate codes expedite customs clearance, reducing delays in cross-border shipments. Cost Optimization: Proper classification ensures you claim valid input tax credits, improving cash flow. Global Trade Alignment: Consistency in HSN codes builds trust with international partners and regulators.

The Classification Conundrum

Servo motor power cables sit at the intersection of multiple HSN categories, making classification tricky. Let’s break down the possibilities:

Option 1: Chapter 85 – Electrical Machinery

Most servo motor cables fall under Chapter 85, which covers electrical equipment. Specifically:

8544 40: “Ignition wiring sets and other wiring sets for vehicles, aircraft, or ships.” 8544 60: “Other electric conductors, for a voltage exceeding 1,000 V.” 8544 70: “Other electric conductors, for a voltage not exceeding 1,000 V.”

Servo cables typically operate below 1,000V, suggesting 8544 70 as a fit. However, this code also includes general-purpose wiring, which may not account for specialized features like shielding or high-flex designs.

Option 2: Chapter 84 – Machinery Parts

Some businesses argue that servo cables are “parts” of machinery, falling under Chapter 84. However, HSN rules specify that parts must be “solely or principally” used with specific machinery. Since servo cables have broader applications, this classification often fails scrutiny.

Option 3: Chapter 39 – Plastic-Insulated Cables

Cables with plastic insulation might seem to fit under 3926 90 (“Other articles of plastics”). But this chapter excludes electrical insulators, making it irrelevant for power cables.

Case Study: A Costly Misclassification

A robotics manufacturer in Pune once classified servo cables under 8544 40 (vehicle wiring), assuming similarities in construction. During a GST audit, authorities reclassified the cables under 8544 70, slapping the company with a 12% tax difference plus penalties. The oversight cost them ₹8.2 lakh and delayed a key export order.

Key Challenges in Classification

Ambiguity in Descriptions: HSN descriptions rarely mention niche industrial components like servo cables. Regional Variations: Countries like the EU or U.S. may interpret codes differently, complicating exports. Technological Evolution: New cable materials (e.g., fiber-optic hybrids) blur traditional categories.

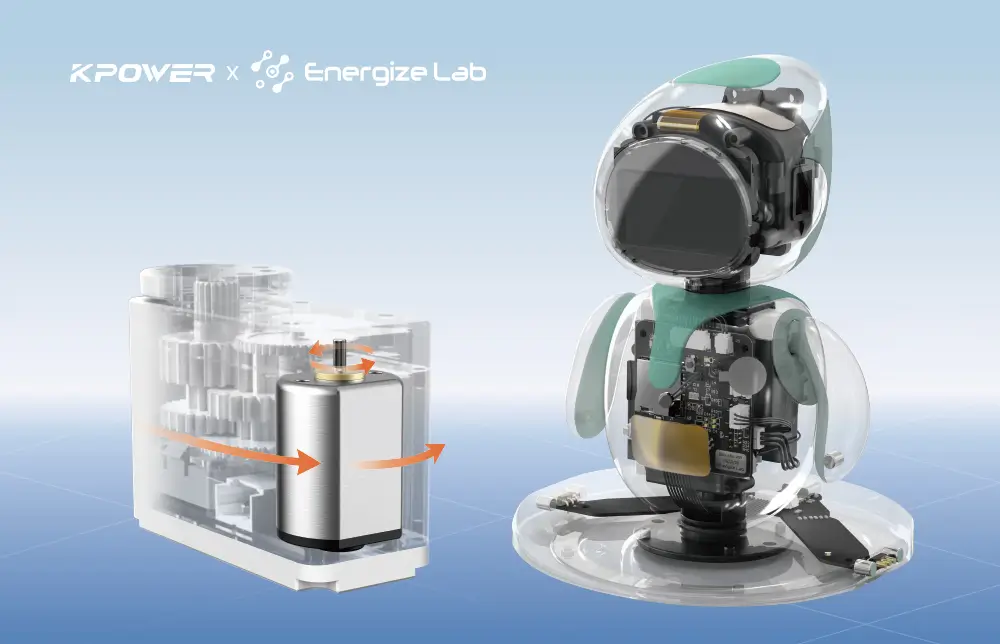

The Role of Customized Solutions

Many businesses now opt for “customs rulings”—binding decisions from tax authorities on product classification. While time-consuming, these rulings provide legal certainty. Alternatively, third-party logistics providers offer HSN advisory services, leveraging AI tools to cross-reference global databases.

Pro Tip: Always include technical specifications (voltage, shielding, insulation) in shipping invoices. This documentation helps resolve disputes during audits.

Mastering HSN Compliance for Servo Motor Power Cables

Having navigated the basics of HSN codes, let’s delve into actionable strategies for compliance, cost savings, and competitive advantage.

Step-by-Step Guide to Finding the Right HSN Code

Analyze Product Specifications: Note voltage ratings, insulation material (PVC, TPE), shielding (braided, foil), and flexibility. Consult the HSN Handbook: Download the latest GST/HSN manual from government portals. Use keywords like “insulated conductors” or “wiring sets.” Leverage Online Tools: Platforms like ICEGATE (India) or the EU’s TARIC database allow real-time code searches. Seek Expert Opinions: Tax consultants or industry forums like IEEE can provide niche insights. Validate with Authorities: Apply for an Advance Ruling under GST Section 98 for legal clarity.

Common Pitfalls to Avoid

Overlooking Updates: HSN codes are revised annually. For instance, 2022 saw new codes for solar cables. Mixing Codes with SAC: Service Accounting Codes (SAC) apply to maintenance contracts, not physical products. Ignoring Partner Requirements: Some EU buyers demand Combined Nomenclature (CN) codes, an extended HSN variant.

The Financial Impact of Accurate Classification

A Mumbai-based exporter of servo systems reduced their GST liability by 5% by reclassifying cables from 8544 40 to 8544 70. By qualifying for a lower tax bracket and claiming ITC on raw materials, they saved ₹14 lakh annually.

Global Trade Considerations

U.S. Imports: Use the Harmonized Tariff Schedule (HTSUS) code 8544.42.00 for “ignition wiring sets.” EU Imports: Apply CN code 8544 49 80 for “other conductors ≤1,000V.” China Exports: Chinese Customs uses 8544.42.00 for shielded cables, often subject to 8% VAT.

Future Trends: AI and Automation

Startups like ClearTax and Zoho GST now integrate AI-driven HSN classifiers. Upload a product image or datasheet, and the tool suggests codes with 90% accuracy. Blockchain platforms are also emerging to create immutable HSN records for audits.

Conclusion: Turning Compliance into a Competitive Edge

In the age of Industry 4.0, servo motor power cables are more than just components—they’re strategic assets. By mastering HSN codes, businesses not only avoid penalties but also unlock faster logistics, better supplier terms, and smoother market expansion. As global trade grows more complex, the companies that invest in precise classification today will lead the automation revolution tomorrow.

Final Takeaway: Treat HSN codes as a living process, not a one-time task. Regularly review classifications, train your finance team, and collaborate with customs brokers to stay ahead. Your servo motors deserve cables that power performance—and your business deserves a tax strategy that does the same.

.webp)