The Role of HSN Codes in Modern Business and Industrial Automation In today’s globalized economy, businesses rely on standardized systems to simplify cross-border trade, taxation, and regulatory compliance. One such system is the Harmonized System of Nomenclature (HSN), a six-digit code used to classify goods universally. For industries leveraging automation technologies like servo motors, understanding HSN codes isn’t just a legal requirement—it’s a strategic advantage.

.webp)

What Are HSN Codes? HSN codes were introduced by the World Customs Organization (WCO) to create a unified language for categorizing products. Over 200 countries use this system, which simplifies customs procedures, reduces trade disputes, and ensures transparency. In India, HSN codes are integrated into the Goods and Services Tax (GST) framework, requiring businesses to mention these codes on invoices for tax calculation.

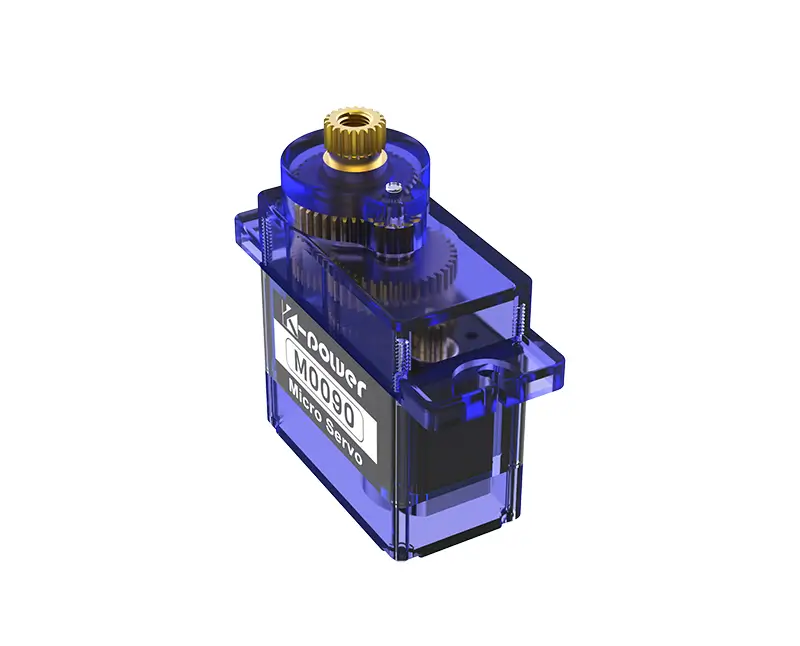

Why Servo Motors Matter in Automation Servo motors are the backbone of industrial automation, robotics, and precision machinery. Unlike standard motors, they offer high torque, accuracy, and responsiveness, making them ideal for applications like CNC machines, conveyor systems, and 3D printing. However, their advanced functionality also means they fall under specific regulatory classifications. Misclassifying them can lead to incorrect tax rates, delayed shipments, or even legal penalties.

Decoding the HSN Code for Servo Motors The HSN code for servo motors is 8501. Let’s break this down:

Chapter 85: Covers electrical machinery, sound equipment, and related parts. Heading 8501: Specifically addresses electric motors and generators. Subheading: Further distinctions (e.g., 8501.10 for motors of an output ≤ 37.5 W) help differentiate servo motors based on power ratings or applications.

Servo motors are categorized under this code because they are electronically controlled devices that convert electrical energy into precise mechanical motion. However, businesses must verify subheadings based on technical specifications like power output, voltage, or torque to ensure compliance.

GST Implications of HSN 8501 In India, servo motors classified under HSN 8501 attract a 18% GST rate. This rate applies to both domestic sales and imports. Importers must also account for Integrated GST (IGST) and customs duties, which vary depending on trade agreements or country of origin. Accurate classification ensures businesses avoid overpaying taxes or facing audits.

Common Challenges in HSN Classification

Technical Complexity: Servo motors often include integrated controllers or feedback systems. Determining whether these components fall under a single code or require separate classification can be tricky. Evolving Technology: As servo motors advance (e.g., IoT-enabled variants), existing codes may not explicitly cover new features, leading to ambiguity. Global Variations: While HSN codes are standardized, some countries modify them for local regulations. Exporters must cross-verify codes with destination countries’ customs databases.

Best Practices for Accurate Classification

Consult Technical Specifications: Review motor datasheets for power ratings, voltage, and application type. Leverage Customs Rulings: Refer to past rulings or seek advance rulings from tax authorities for clarity. Use Automation Tools: GST software with built-in HSN databases can reduce human error.

Case Study: A Robotics Manufacturer’s Journey A Pune-based robotics company faced delays in exporting servo-driven assembly line equipment due to incorrect HSN codes. By collaborating with a tax consultant, they identified the correct subheading (8501.30 for DC motors > 750 W) and streamlined their export process, reducing clearance time by 40%.

Navigating International Trade and Future Trends in HSN Classification While Part 1 covered the basics of HSN codes for servo motors, this section dives into their role in global trade, emerging challenges, and how businesses can stay ahead.

HSN Codes in Global Supply Chains For companies importing or exporting servo motors, HSN codes act as a universal passport. For instance, a German manufacturer shipping motors to India must use HSN 8501, while Indian exporters to the EU must align with the EU’s Combined Nomenclature (CN) code 8501. Harmonizing these codes ensures smoother customs clearance and minimizes duty disputes.

Impact of Free Trade Agreements (FTAs) Many countries have FTAs that reduce tariffs on specific goods. For example, India’s FTA with ASEAN nations might offer lower duty rates for servo motors classified under 8501. However, businesses must provide certificates of origin and ensure their products meet “value addition” criteria to qualify. Misclassification here could forfeit cost savings or trigger penalties.

Customs Audits and Risk Management Tax authorities increasingly use data analytics to detect discrepancies in HSN reporting. A mismatch between declared codes and product descriptions can lead to audits, fines, or supply chain disruptions. Proactive measures include:

Conducting internal audits of past transactions. Training procurement and logistics teams on HSN updates. Maintaining detailed records of product specifications and classifications.

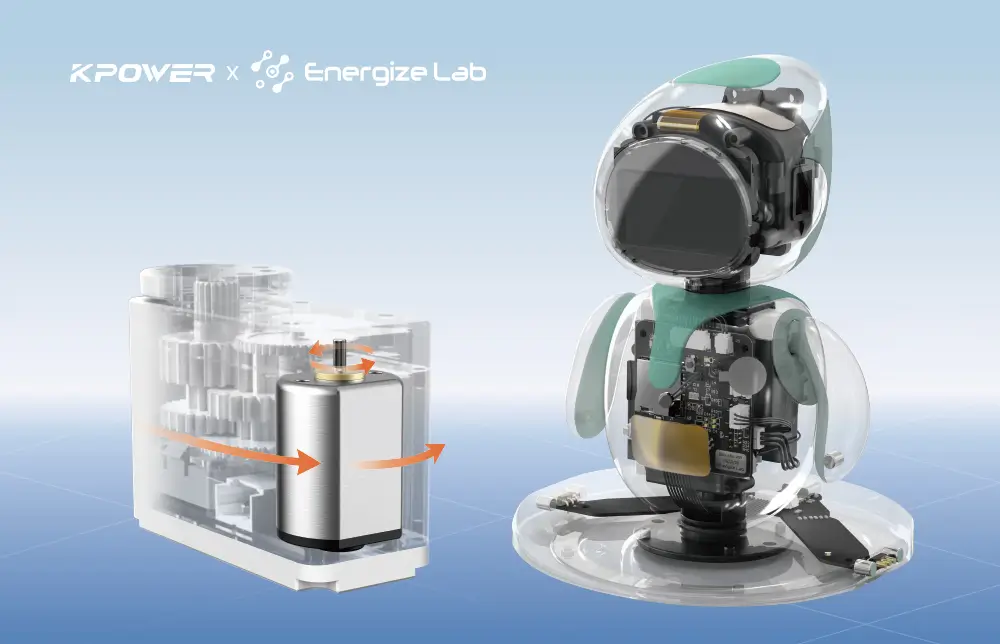

The Rise of Smart Servo Motors and HSN Adaptability Modern servo motors now feature IoT connectivity, AI-driven diagnostics, and energy-efficient designs. These innovations blur the lines between traditional machinery and digital devices. While HSN 8501 remains the primary code, auxiliary components like sensors or communication modules may fall under separate codes (e.g., 8537 for control panels). Businesses must adopt a modular approach to classify hybrid products accurately.

Government Initiatives and Digital Tools To simplify compliance, governments are launching digital platforms. India’s GST Network (GSTN) offers a searchable HSN directory, while the WCO’s Harmonized System Database provides global updates. Additionally, AI-powered classification tools can analyze product descriptions and suggest codes, reducing manual effort.

Future-Proofing Your Business

Stay Updated: Follow revisions to the HSN system, which occur every five years (the latest in 2022). Collaborate with Experts: Partner with customs brokers or tax advisors to navigate complex scenarios. Invest in Training: Regular workshops for finance and operations teams can mitigate classification errors.

Case Study: E-Commerce and Cross-Border Challenges An Indian e-commerce platform selling servo motors globally faced inconsistent tax filings due to varying HSN interpretations in the U.S., UAE, and Australia. By integrating a cloud-based compliance tool with multi-country HSN/HS code databases, they automated classification and reduced errors by 70%.

Conclusion: HSN Codes as a Strategic Asset Understanding HSN codes for servo motors isn’t just about compliance—it’s a competitive edge. Accurate classification accelerates cross-border trade, optimizes tax liabilities, and builds trust with authorities. As industries embrace Industry 4.0, businesses that master HSN nuances will lead the automation revolution.

By demystifying HSN codes, companies can focus on innovation, leaving regulatory complexities to streamlined processes and smart tools. Whether you’re a manufacturer, importer, or tech startup, the right knowledge transforms codes from bureaucratic hurdles into catalysts for growth.

.webp)