When you pick up a remote controller—whether for your television, drone, or gaming console—you might not think about the complex web of tariffs, customs regulations, and international trade policies that govern its movement across borders. Yet, nestled beneath the simple plastic exterior of these devices lies a vital code: the HS code.

HS codes, or Harmonized System codes, form the backbone of global trade documentation. Developed and maintained by the World Customs Organization (WCO), this standardized system categorizes goods into specific codes, facilitating smoother customs procedures and accurate tariff application. For importers, exporters, and logistics providers alike, understanding the HS code associated with their products is not just a bureaucratic requirement—it’s a strategic necessity.

What Are HS Codes and Why Do They Matter?

The Harmonized System is a universal language used by over 200 countries to classify traded products. It assigns a unique numerical code—usually consisting of six digits—that identifies the product’s category, subcategory, and specific description. This code helps customs officials determine the applicable duties, taxes, and regulatory compliances for your goods.

For remote controllers, the HS code helps distinguish between various types, such as infrared remote controls, RF (radio frequency) controllers, or specialized controllers for gaming or industrial purposes. Each category has its own classification, and precision here affects tariffs, licensing, and import/export restrictions.

Misclassification can lead to delays, hefty fines, or even seizure of shipments. For instance, a remote control for a TV might have a different HS code than a remote used for a drone or industrial machinery. Being exact—and staying updated—is critical for successful international trade.

The Impact of HS Codes on International Trade

In the universe of global commerce, time and certainty are of the essence. An accurate HS code streamlines customs documentation, reduces clearance times, and minimizes delays. Conversely, incorrect or ambiguous coding can cause shipments to be held at customs, increasing costs and frustrating customers.

Trade agreements and tariffs often hinge upon the HS code—particular codes may be eligible for preferential treatment under free trade agreements (FTAs) or subject to specific import tariffs. Knowing the correct HS code also helps companies plan for costs, forecast margins, and avoid surprises.

Suppose a firm in the United States exports remote controllers to the European Union. By applying the correct HS code, they may qualify for reduced tariffs or be more likely to pass customs checks without issues. On the other hand, relying solely on broad categories or outdated codes can lead to misclassification.

How Are HS Codes Determined for Remote Controllers?

Classifying a remote controller begins with analyzing its features—its construction, function, and intended use. For electronic devices, the common practice is to refer to the global HS classification guidelines alongside national customs coding systems.

Most customs authorities provide detailed tariff schedules and classification principles. For remote controllers, one typical code is under Chapter 85—Electrical machinery and equipment and parts thereof. Within this chapter, specific headings address remote controls, remote controls for TVs, or related accessories.

For example, a generic infrared remote control might fall under heading 8526.92, which covers “Radiotelephone or radiotelegraphy remote controls." For gaming or industrial remote controllers, different subheadings could apply.

Determining the exact code involves reviewing product specifications, technical datasheets, and sometimes consulting customs experts or classification rulings. Many companies also rely on customs classification databases or software tools that streamline this process.

The Role of Customs Tariff Databases and Resources

To navigate the complexities of HS code classification, several online resources and tools are invaluable:

International Customs Tariff Databases: The World Customs Organization provides harmonized tariff schedules that serve as the foundation for national classifications. National Customs Websites: Countries often publish detailed tariff codes and classification guidelines—such as the U.S. Harmonized Tariff Schedule (HTS), the European Union TARIC database, or China's Customs Import and Export Tariff. Trade Data Platforms: Commercial platforms provide search tools for HS codes, including descriptions, tariff rates, and customs procedures. Consultation with Customs Experts: For complex or unusual products, expert advice ensures accurate classification, avoiding costly mistakes.

The Importance of Proper Documentation

Once the correct HS code is determined, it should be clearly indicated on all shipping documents, including invoices, packing lists, and customs declarations. Consistency across documents minimizes the risk of misclassification and ensures a smoother clearance process.

If a shipment's HS code is wrong or inconsistent with the actual product, customs authorities may seize the shipment, impose penalties, or require reclassification. This is why due diligence and accuracy are paramount.

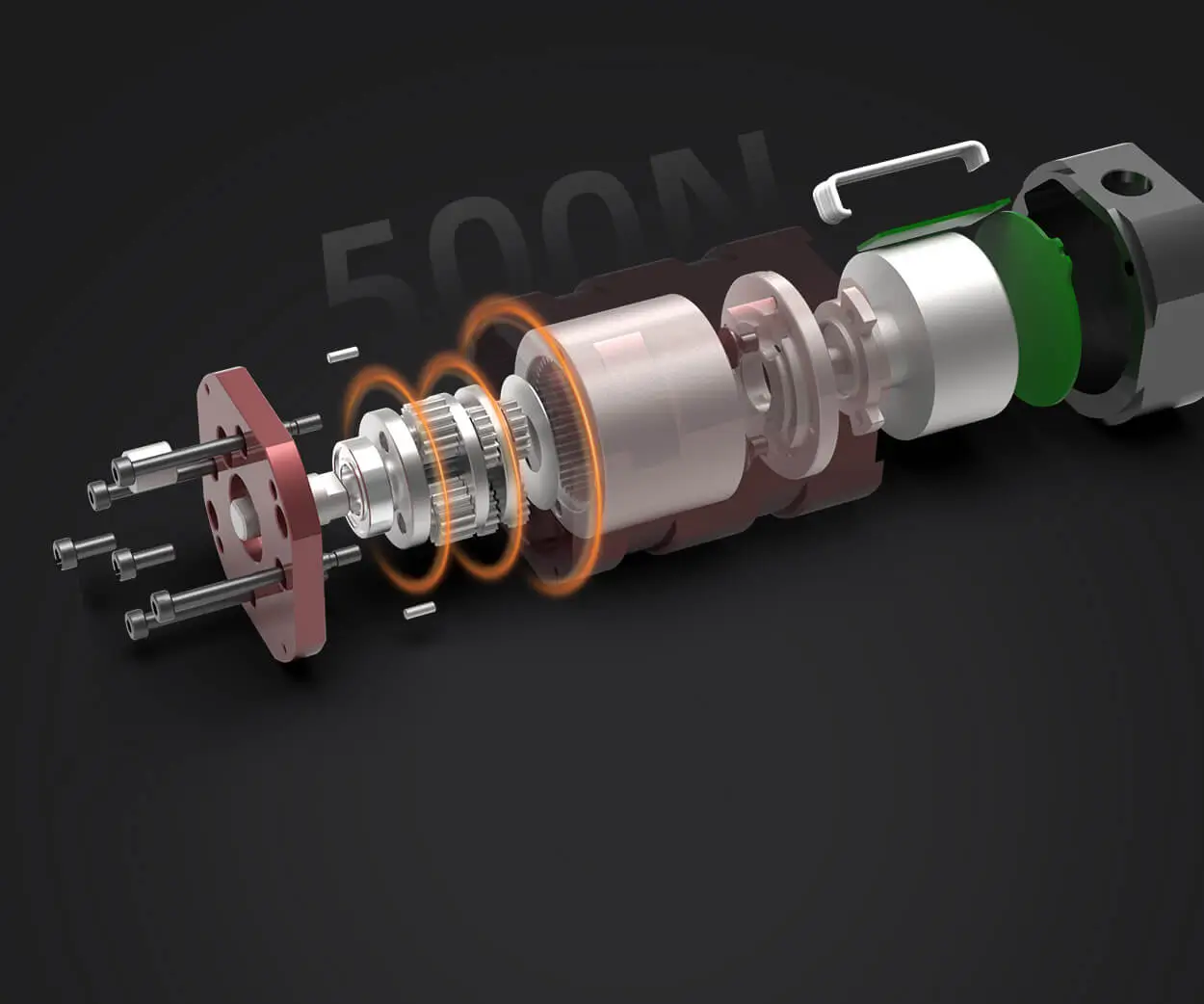

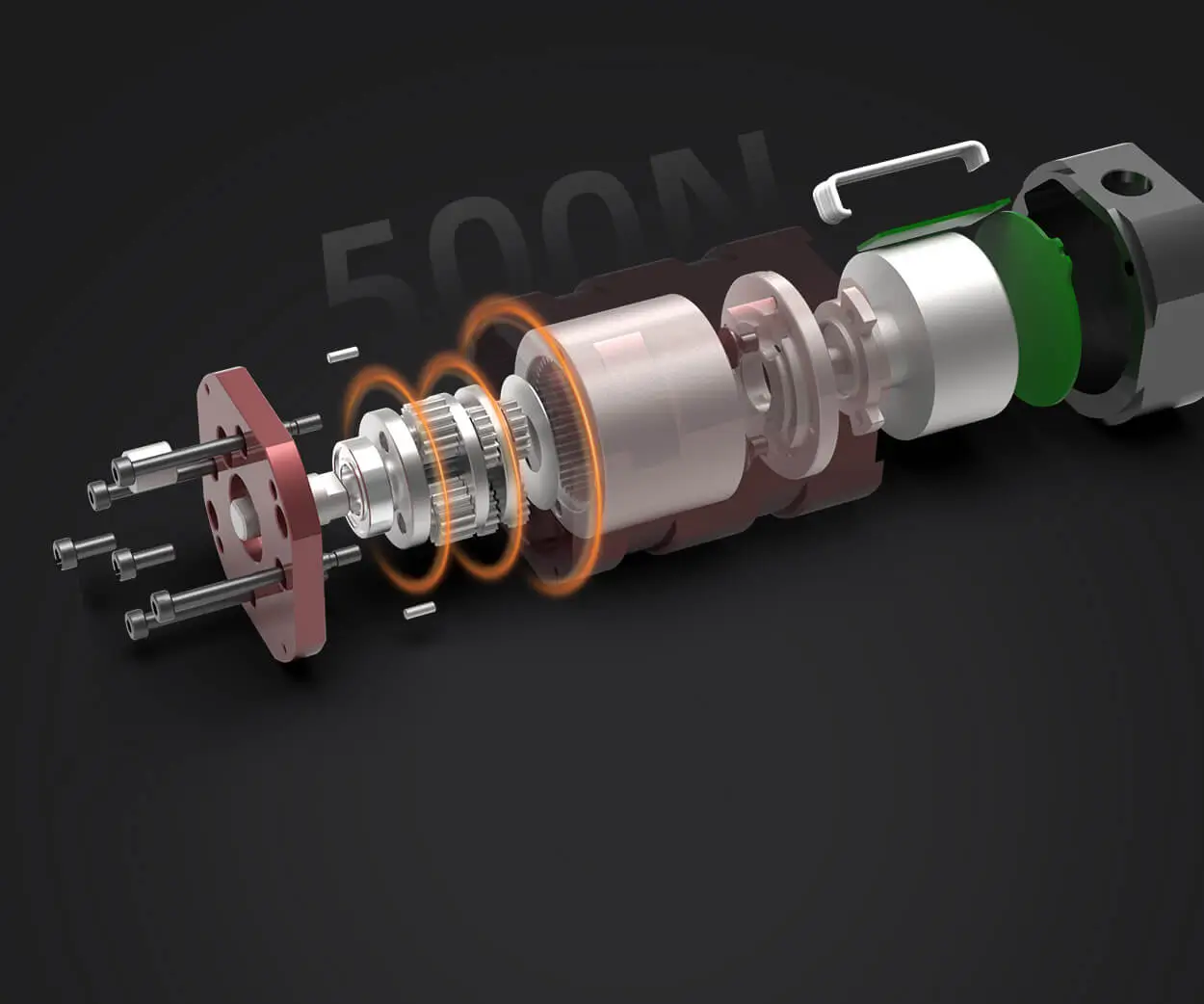

Established in 2005, Kpower has been dedicated to a professional compact motion unit manufacturer, headquartered in Dongguan, Guangdong Province, China.